After reading this article you will learn about the Current Status of vegetable seed industry in India.

India produces about 90 million tons of vegetables (excluding potato, sweet potato, tapioca and including chilli) from about 6.72 million hectares and retains second position after China. With this production and our current population of about 1.10 billion, the availability of vegetables/capita/day comes to about 175 g factoring in the post-harvest losses of about 25%.

The per capita, per day requirement of vegetables is about 300 g and thus we have to produce close to 150 tons of vegetables to meet out domestic requirements. This leap can best be achieved by use of improved varieties and hybrid technology in combination with superior crop management technology.

Substantial increases in productivity can thus be achieved even with diminishing land and water resources provided we use better seeds equipped with better traits under superior crop agronomy.

One can visualize the current status of seed industry going through a few simple statistics as given below followed by the flow chart:

Thus, it is obvious that the global seed industry is almost equal to pesticide industry (35 to 40 billion USD). However, both are much smaller than the pharmaceutical industry which has a market worth of about 500 billion USD.

Indian seed industry accounts only for about 1.5 billion USD (INR 7000 crores) out of which vegetable seed industry accounts for about INR 1000 crores and the cotton and the field crops seed are worth about INR 6000 crores where cotton alone accounts for INR 2000 crores and the remaining field crops are responsible for about INR 4000 crores of seed annually.

According to some very recent estimates by the seed industry professionals and experts in India, the vegetable seed market is close to INR 1500 crores.

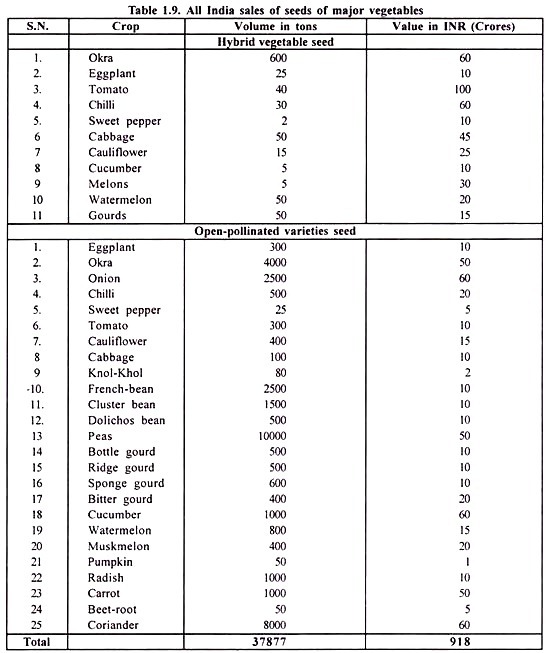

In vegetable seed business in India, the major players are Nunhems (a subsidiary of Bayer Crop Science), Seminis (a subsidiary of Monsanto), Syngenta (Switzerland based MNC), Namdhari Seeds, Mahyco Seeds, Krishidhan Seeds, Bio seeds, Nuziveedu Seeds, Rasi Seeds and others. As per various estimates available, the volume and the value of vegetable seeds traded in India in different vegetables is given in Table 1.9.

According to Anand (2003) hybrid vegetable technology has made significant impact in most crops in developed world. India has not lagged behind in adopting this technology. The estimated area under vegetable hybrids has gone up from 192,100 ha in 1993-94 to 416,013 ha in 1999-2000. Vegetable production increased from an average of 10.5 t/ha in 1991-92 to 15.2 t/ha in 1999-2000 amounting to an increase of 52%.

With intensive cultivation using hybrids, the average yields under open field condition in India has been steadily increasing and the yield difference with the developed countries is getting narrower. It is not uncommon to see growers achieving yields of 100 tons/ha in tomato, 50 tons/ha in watermelon, 70 tons/ha in eggplant and 35 tons/ha in chilli pepper.

The advantage conferred by hybrids include higher yields, increased harvesting period, better adaptability, better shelf-life and transport quality favoring growers and occasional disease resistance. The consumers are benefited by superior quality of hybrids in terms of eye appeal, better keeping quality and some times hidden and yet all important nutritional value.

Realizing the benefits in terms of higher productivity and enhanced income hybrid vegetable cultivation has become popular in traditional vegetable belts and there is up-ward increasing trend.

In transformation of largely unorganized vegetable seed sector into a more organized one, the policies of the Government of India have played a greater role. In 1998, the private sector got a boost in growth with the removal of restriction by a Govt. order liberalizing seed import through open general license (OGL) and removing tariff barriers.

This move resulted in import of hybrid seeds in cabbage, cauliflower, chillies etc. besides large quantities of seeds of carrot and beetroot by private seed companies. This act also encouraged healthy competition in local research efforts leading to release of several hybrids by the private seed industries.

Subsequently, foreign direct investment flow increased, joint ventures (JVs) were set up and there was import of elite germplasm of vegetables.

Presently private sector seed industry comprises of the following categories:

1. Local domestic companies dealing predominantly with open pollinated varieties.

2. Indian companies marketing hybrids sourced from abroad.

3. Indian companies developing, producing and marketing hybrids.

4. Foreign companies (JVs or subsidiaries) having R&D, production and marketing network and infrastructure.

5. Foreign companies marketing their products developed abroad.

The R&D expenditure by most of the private seed companies ranges between 4 to 8% and ideally it should be around 10%.

The hybrid vegetable seed industry in India accounts for about 40% of the total traded seed. Among hybrids, tomato, chilli, okra and cabbage occupy the prime position. Among the hybrid seeds sold, almost the entire quantity of cabbage is imported followed by cauliflower (70%).

Other major imports include chilli pepper and sweet pepper hybrid seeds. These are examples of successes in vegetable seed trade stimulating growth of the industry.

The area under hybrids in cabbage, tomato and watermelon is estimated to be in excess of 50% of the total area under respective crops. In chilli pepper and okra the area under hybrids is increasing. As a matter of fact, India is perhaps the second largest user of hybrid seed in tomato after USA.

The market is getting more refined in terms of quality and yield expectations and there is a clear demand for perfect hybrids in tomato. Dual purpose and processing hybrids (determinate) account for the major market share. The market requirements also include hybrids with resistance to major tropical diseases like bacterial wilt and tomato leaf curl virus (TLCV).

TLCV resistant segment is becoming important, with rapid spread of this disease. Indeterminate hybrids are grown in some places. The harvesting season is extended in these hybrids and the fruits have good transport quality. Hybrids with high yields, high acid fruits have a fairly large share of the market in south.

Besides the classes of tomato mentioned, there is a need for hybrids with resistance to tomato spotted wilt virus in south and west, higher levels of resistance to TLCV and cold tolerant hybrids for sowing in October in the north.

Cabbage is a popular crop in this subcontinent and hybrids have almost completely replaced open pollinated varieties in most areas. The quantity of cabbage hybrid seeds sold is estimated to be as high as 50 tons. Preferences for size and shape vary widely between regions and also between seasons in the same region.

In West Bengal the season begins (June/July) with KK cross type, moves to Green Express type for August sowing and in the main season, hybrids with very firm heads, weighing two kg and with good field holding capacity are popular.

In Maharashtra, small (1 kg) round firm heads are preferred while in Karnataka, varieties with large, semi flat (2.5 kg) heads dominate the market. In general, resistance to black rot and diamond back moth, heat tolerance and good field holding capacity are important requirements in cabbage.

In Chilli, during the last five years there has been a rapid change to hybrids in most states, especially in the largest chilli growing state of Andhra Pradesh. In this crop also there are different market needs with distinct preferences for pungency and colour.

While very pungent (>70,000 Schoville Heat Units) fruit is the requirement for use in fresh market and as dry powder, medium pungency (30,000 SHU) is required for pickle making and low pungency coupled with attractive deep red colour is another preference.

The growers’ need also includes resistance to virus complex and anthracnose fruit rot. Hybrids with resistance to viruses have maintained their market share. Better export promotion strategies in this crop will support increased growth and seed sales.

In watermelon a popular public bred variety like Arka Manik has been replaced by hybrids. The hybrid market share in this crop is around 50 tons. The market prefers early hybrids with large size (12 kg), oval to oblong in shape, very good transportability, internal qualities of color, taste (TSS-13%) and texture.

Presently, the hybrid watermelon market is dominated by Jubilee pattern throughout the country. Sugar Baby and Charleston types are also grown in some areas while a small market for icebox type (3-4 kg fruits) is emerging. Resistance to Fusarium wilt and tospo virus is the major requirements for the future.

Okra is a popular Indian vegetable and is estimated that presently 600 tons of hybrids seeds are sold annually. Most companies vie for a share of this market, wherein resistance to yellow vein mosaic virus (YVMV) is mandatory. With other viruses like enation leaf curl also showing up, it becomes important to have multiple virus resistant hybrids.

Although melons are grown in most parts of the country, hybrids are mostly restricted to Haryana. Punjab and Rajasthan belts. Consistent yields, good fruit and transport quality are critical traits. Netted cantaloupe types are preferred while Honeydew, sutured melon and Galia types have some niche market. Resistance to virus complex, Fusarium wilt, better adaptability and shipping qualities will favors wider usage of hybrids.

Good quality cauliflower curds are found almost throughout the year due to successful varieties in early, mid and late season groups. In south and west, early and mid season groups are dominated by hybrids. Consistency in curd color and quality, size and black rot tolerance are prime needs besides suitability to extended sowing periods.

Market needs for eggplant are varied, depending on fruit color and shape and size. Round with purple and white stripes (with & without spines), green long, purple long, green round and large purple oval are major segments in this crop.

In traditional Indian vegetables like cucumber and Indian Gourds (bitter gourd, bottle gourd and ridge gourd) also, hybrids are gaining popularity. Hybrids are preferred because they are early, higher yielding and more uniform. In cucumber, the Asiatic type (green to light green 15-18 cm long) is widely grown.

Although there is diversity in types of products required in each of these crops, many of the companies are able to meet the needs through their breeding efforts. The farmers are also willing to pay more for hybrid seeds, especially if they have some value addition.

Hybrid acceptance in tomato, cauliflower, cabbage and watermelon has been spectacular. Acreage under hybrid okra, chilli pepper, eggplant and melons have shown tremendous increases in the last few years. It is expected that in cucumber and Indian gourds also significant increase in hybrid seed volumes will be seen.

The open pollinated seed market in India is presently estimated to be around $ 118 million (Local and unidentified varieties, referred to as farmer saved seeds, even now occupy large areas.

These estimates are as high as 30 to 50% of the total area in chilli pepper, cauliflower and eggplant, 15 to 20% of the area in tomato and okra, and above 60% of the area in melons. In this class of seeds, cucumber ranks first among the crops in seed sales ($14.34 million), followed by onion ($ 12.30 million) and okra ($ 9.85 million).

Among the imported seeds sold, coriander ($16.33 million) and carrots ($15.99 million) are valued higher than all others. French beans, cluster beans and dolichos beans have significant seeds sales in the beans group. Cauliflower of different maturity groups for north and east markets, radish, cucumbers and all types of gourds have large sales.

A number of superior varieties have been developed and released by Universities/Institutes in various states and many of the private companies and seed corporations produce and market the seeds of select varieties in significant quantities. There is sufficient room for growth in this seed sector to replace the local seeds although there is shift to hybrids in some of the crops.

Another significant achievement of the private sector in the open pollinated seed segment has been the import and popularization of high yielding multi-cut coriander, Kuroda, and Nantes carrot with better colour and adaptability and beetroot of high color and good uniformity.

Production of quality seeds in self and cross-pollinated crops, capability to import quality seeds of carrot, beetroot and coriander and neat packaging have helped in sustaining the growth of seed sales in this sector. Greater use of improved varieties and reduction in use of saved seed can be expected to result in enhanced yields and therefore better returns for the growers.

Vegetable Seed Production:

India figures among the top three vegetables seed producing countries in Asia requiring hand pollination, others being China and Thailand. In India, commercial seed production for export on a commercial scale was organized during the 70s by two private companies.

A number of medium and small sized companies have begun to operate now in this venture covering seed production in most of the solanaceous and cucurbitaceous crops for internal market and exports.

These companies include Namdhari Seeds, Mahyco, Indo American Hybrid Seeds, Golden Seeds, Tropica, Exim, Oriental Biotech, Unicorn Biotech, Krishidhan Seeds etc. Custom production for export is mainly for companies in US, Europe and Japan. Vegetable seed export constitutes nearly 70% of total seed exports. It is estimated that seeds valued at $ 63 million have been produced and exported during 2000-01.

India is endowed with several advantages making it competitive for production of hybrid vegetable seeds for foreign companies and meeting international seed quality standards. Seed production areas have been identified, developed and seed villages organized on a professional scale.

Reasons for India’s success in hybrid seed production include availability of skilled labour (pollinators and growers) at competitive rates, skilled supervisors and favourable climate for production of major crops like tomato and cucurbits over an extended production season. Systems to import parent seeds and export of hybrid seeds are in place. The Government has been supportive of export-oriented activities.

The state of Karnataka produces nearly 90% of the total hybrid vegetable seeds, the major areas being located around Ranebennur in the northern part of the State. Availability of trained labour and guaranteed returns and incentives for quality have helped in setting up of several seed villages.

The returns can be as high as three times as that of crops for market purpose from the same area. This has also helped in improving the socio-economic scenario of these regions, including overall prosperity, narrowing down of rural/urban divide and employment generation especially for village women and youth.

It is estimated that the total employment generation is over 7,00,000 in this sector. This is one of the most significant achievements of this agricultural activity leading to improved per capita income and quality of life. Hard work and diligence of the farm workers involved have helped in meeting the international seed quality standards, which in turn has led to continued growth of the business.

New areas for production are also being added, extending this benefit to other rural areas. India has a major advantage in having a choice of latitudes and altitudes to select appropriate seed production areas. Some of the progressive companies have also set up greenhouses for successful production for difficult-to-produce crops like capsicum.

Availability of quality technical expertise, increased production and productivity of hybrid seeds of international standards, reduced risks and maintaining low costs have helped to make custom seed production a viable opportunity for foreign companies in India.

Public Sector – Contributions and Strengths:

The initial impetus to the vegetable variety development was from public institutes. Several high yielding varieties in many crops were released including some with disease resistances. These institutions continue to develop and release new varieties and hybrids.

Popular varieties released by the Institutes are produced and marketed by many small and medium sized companies. These include Arka Anamika in okra, Arka Manik in watermelon, Arka Vikas in tomato, G4 in chillies, Hara Madhu in melons, Arka Komal in beans besides others.

The private seed companies have also been benefited as these releases formed the base material for the start of their breeding programmes. Okra hybrids developed and sold by private companies today owe their success to release of okra cultivars resistant to YVMV like Arka Anamika, Parbhani Kranti and A4.

In tomato also, the private industry has successfully used the bacterial wilt resistant lines released from public institutes like IIHR, Bangalore to develop resistant hybrids. Many of the Institutes and Universities have formulated rules by which the seed companies can buy their varieties including parents of hybrids.

Several MOUs are in place and SAUs/ICAR institutes are more than willing to market their technologies through private sector seed companies.

Biotechnology is an important growing area today with wide applications. The tools of molecular biology can supplement conventional breeding programmes enabling great advances in crop improvement. Many of the public Institutes have reasonably strong programmes in this area.

The areas include marker – assisted section (MAS), markers for use in purity tests and transgenics. Some of the companies have state of the art laboratories for molecular biology. Projects underway in Institutes and private companies include introduction of Bt gene into brinjal, tomato, cauliflower and chillies for insect resistance as well as engineering TLCV resistance in tomato.

It would be important to prove the usefulness of the introduced gene(s) and also demonstrate bio-safety aspects. With regulatory agencies in place, testing procedures and schedules worked out, it is expected that transgenics, when developed with the advantages demonstrated will find favors with the growers.

Strong linkages and joint operational projects in areas of molecular biology with public institutes will help medium sized private seed companies to utilize the scientific talent available in public institutes and benefit from costs of research.

As a matter of fact, Genetic Engineering Approval Committee (GEAC) of Ministry of Environment and Forests, Govt. of India, cleared some Bt brinjal hybrids developed by M/s Mahyco in its 97th meeting held on 14.10.2009.

However, considering the fact that there were opposing opinions by several groups and organisations and this was going to be the first GMO release in India in food crops, the committee forwarded the recommendations to Hon’ble Minister of Environment and Forests who imposed a moratorium on 9.2.2010 on its commercial release till further order. The genes/sequences involved in this Bt brinjal were cry 1Ac, npt II and aad.

Government and Seed Industry:

During the last decade, Governments, both central and state, and other related agencies have been supportive and proactive. It can be expected that further removal of controls and restrictions, which impede growth of the industry, will facilitate in making this sector stronger. India is also a signatory to WTO and the barriers for seed trade have been removed.

PPVFRA- 2001 has been enacted by the Parliament and this is expected to generate more investments in R&D. Government Institutes provide breeder seeds at reasonable prices. Private seed company hybrids are being evaluated in coordinated trials conducted by ICAR.

Above all, removal of seed trade barriers in 1988 has been a milestone. This new seed policy greatly helped import of vegetable seeds. As a further fillip to this industry, under the industrial policy, seed production was declared as a high priority industry in 1991.

Private Sector – Seed Industry – Future Perspective:

The growers and consumers today have a better and wider choice of products and this has a strong parallel with the activities and offerings from the private seed sector. R&D activities have been strengthened and new hybrids with disease resistance and better quality have emerged from private sector, which are rapidly gaining ground.

In crops like tomato, cabbage, cauliflower, chilli pepper, melon, watermelon and okra where strong hybrids have emerged and growers have not hesitated to pay more for value added products like disease resistance, seed sales have grown over the years.

While there appears to be room for rapid growth in okra, chilli pepper, and cucumber, incorporation of speciality traits and disease resistance genes will be the key for augmenting growth of hybrid seed sales in tomato, melon, watermelons, cauliflower etc.

Eco-friendly hybrids with biotic/a biotic stress tolerance will have big market share and these are expected to perform well in off-seasons also. Products with good transport quality and better shelf life will be preferred by traders and also by consumers.

Choice of growers and consumers keep changing and is not consistent over regions. It is important that R&D units reorient on shifting time scales dictated by market compulsions.

Super market in cities bringing in quality vegetables, well packed and presented provide scope for premium quality, unique new products and convenience items (icebox watermelon) as well as novelty items (cherry tomato, coloured bell pepper, baby corn, asparagus, lettuce etc.). Processing industry will have specialized needs in crops like tomato and chilli pepper.

Efforts to economize seed production costs will be important. Seed quality and treatment will become key points for growers to make choices and there is a need for upgrading quality control laboratories to meet international standards. Biotechnology products will have scope if clear advantages are demonstrated along with safety aspects to consumers.

A right blend of research activities of private and public enterprises is prevailing. Import of cabbage, cauliflower, chilli and capsicum hybrids besides large volumes of open pollinated varieties in carrot, beetroot and coriander exemplifies the successful functioning of international seed trade. Seed associations are ready to take up the cause of the industry, to support effective and efficient seed trade with other countries for imports.

Success and continued growth in the private sector will depend on customer needs, development of need-based hybrids, development of efficient and appropriate technologies in frontier areas and germplasm enhancement. The Indian vegetable seed industry has the requisite technological skills and strength to provide the varietal needs of the future.

India has a unique opportunity in terms of breeding a range of vegetable crops. Competent breeders capable of developing superior hybrids, backed by strong production capabilities can galvanize the industry towards development of hybrids not only for the Indian subcontinent but also for other Asian and middle-eastern countries. India has a vibrant vegetable seed industry and appears to be on the right track for a bright future.